DOGE Price Prediction: Technical and Sentiment Analysis for 2025

#DOGE

- DOGE is trading below its 20-day moving average, indicating short-term bearish pressure, but MACD shows positive momentum potential.

- News sentiment is mixed, with whale activity supporting prices but low wallet activity and de-risking suggesting caution among large holders.

- Key support at $0.2067 (Bollinger Lower Band) is critical; a hold could lead to a rebound, while a break may trigger further declines.

DOGE Price Prediction

Technical Analysis: DOGEUSDT

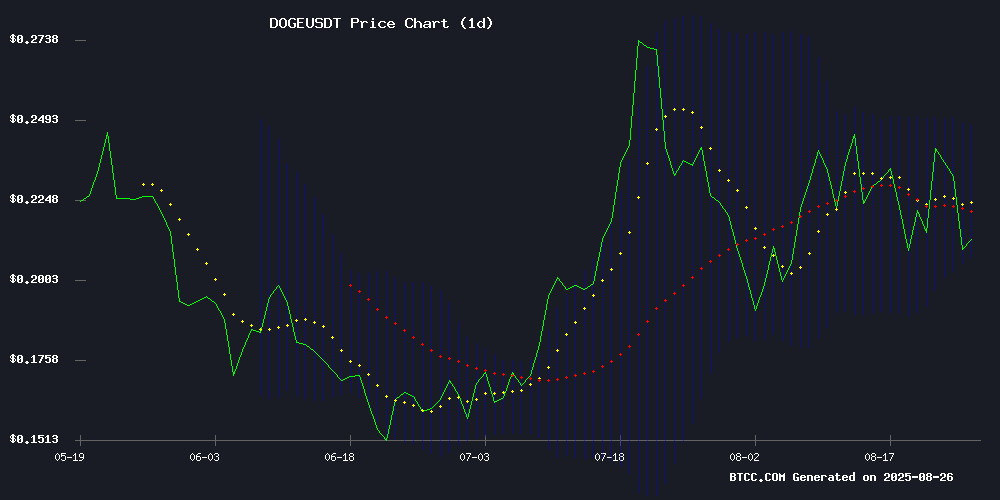

According to BTCC financial analyst Mia, DOGE is currently trading at $0.21108, below its 20-day moving average of $0.22727, indicating short-term bearish pressure. The MACD shows a positive histogram of 0.004193, suggesting potential momentum building despite negative signal lines. Bollinger Bands position the price NEAR the lower band at $0.20674, which could act as support. Mia notes that a break below this level might trigger further declines, while holding could lead to a rebound toward the middle band at $0.22727.

Market Sentiment Analysis

BTCC financial analyst Mia comments that recent news highlights mixed sentiment for DOGE. Headlines indicate bearish pressure testing key supports, yet whale activity and breakout patterns suggest potential upside. However, low wallet activity and de-risking by large holders temper optimism. Mia emphasizes that technical levels align with this cautious outlook, requiring confirmation above $0.227 for a bullish shift.

Factors Influencing DOGE's Price

Dogecoin (DOGE) Faces Bearish Pressure as Price Tests Key Support Levels

Dogecoin's price trajectory turned downward after breaching the $0.2320 support level, mirroring broader market trends seen in Bitcoin and Ethereum. The meme cryptocurrency now hovers near critical thresholds, with bears targeting a breakdown below $0.20.

Technical indicators reveal a concerning pattern—DOGE trades below both the $0.2150 psychological level and the 100-hour moving average. A bearish trend line has formed with resistance at $0.2160 on hourly charts, creating a potential ceiling for recovery attempts.

Market participants watch two key scenarios unfold: either a continuation of the downtrend toward $0.2050, or a reversal if bulls can reclaim $0.2280 resistance. The 50% Fibonacci retracement level NEAR $0.2365 marks the next significant hurdle for any sustained upward movement.

Dogecoin Whales Push Price Higher: Next Stop $1?

Dogecoin has surged back into the spotlight as large holders accumulate hundreds of millions of DOGE, driving prices upward. Whale activity has intensified, with August alone seeing between 680 million and 2 billion Doge scooped up—now representing nearly 18% of circulating supply. Technical indicators flash bullish: a golden cross formation and double-bottom pattern near $0.21-$0.22 suggest strengthening momentum.

Analysts speculate the meme coin could breach resistance at $0.30-$0.50, potentially eyeing $1 or beyond. Institutional interest adds fuel to the rally, though Qubic-related 51% attack concerns linger. Meanwhile, MAGACOIN FINANCE emerges as another speculative contender in the meme coin cycle.

Dogecoin Stalls Near $0.22 as Analysts Spot Potential Breakout Pattern

Dogecoin (DOGE) hovers around $0.22, trapped in a tightening range that hints at an impending breakout. The memecoin dipped 5% in the past 24 hours but remains flat weekly, with trading volume exceeding $3 billion.

A symmetrical triangle pattern on the 4-hour chart suggests an explosive MOVE is imminent. Analyst Ali Martinez notes DOGE is nearing the lower boundary of this formation, predicting "one last dip before the breakout." Key levels include support at $0.22 and resistance between $0.24-$0.25.

Trader Tardigrade applies Elliott Wave Theory, identifying DOGE in the final correction phase before a potential surge toward $0.30. Chart analyst Umair highlights $0.25 as a critical pivot—reclaiming it could propel DOGE to $0.31, while failure risks a drop to $0.1949.

The Relative Strength Index (RSI) at 57 reflects balanced momentum, leaving traders watching for the next decisive move.

Dogecoin Price Forecast: Whales De-Risk Amid Low Wallet Activity

Dogecoin's decline risks extending toward $0.20 as large holders offload DOGE, reflecting broader market risk-off sentiment. Daily Active Addresses remain low, potentially fueling further sell-offs.

Futures Open Interest has dropped to $3.54 billion from July's $5.35 billion peak, signaling weakening trader confidence. Addresses holding 10-100 million coins now control 16.11% of supply, down from 16.85% in mid-July.

The meme coin's recovery appears increasingly elusive as derivatives data shows shaky interest. While some signs of stabilization emerge, any sustained uptrend WOULD require time to materialize.

Is DOGE a good investment?

Based on current data, DOGE presents a high-risk opportunity. BTCC financial analyst Mia highlights that the price is below key moving averages, indicating short-term bearishness, but MACD momentum and Bollinger Band support near $0.2067 offer potential for rebounds. News sentiment is mixed, with whales driving volatility but low activity suggesting caution. For investors, consider the following table summarizing key metrics:

| Metric | Value | Implication |

|---|---|---|

| Current Price | $0.21108 | Below 20-day MA, bearish short-term |

| MACD Histogram | 0.004193 | Positive momentum building |

| Bollinger Lower Band | $0.206735 | Key support level |

| 20-day MA | $0.227272 | Resistance to overcome for bullish trend |

Mia advises monitoring the $0.2067 support; a break lower could signal further declines, while holding may lead to a test of $0.227. Given the volatility and mixed signals, DOGE is speculative and suitable only for risk-tolerant investors.